Published in the September 2020 Issue – The United Arab Emirates government has created opportunities for its own citizens and for international industry partners to create and grow an indigenous defence industry that not only adds value to existing IP, but is an innovator and IP owner in its own right.

One of the challenges of starting a new industrial sector in a developing country, both for the national government and for international OEMs and tier industries, is to find enough local ‘talent’ to stay and grow professionally with the sector as it becomes established.

In the United Arab Emirates, Emiratisation has long been an ambition of the government. With a smaller local population compared to the number of expatriate residents in the country, the aim has been to encourage Emiratis to begin and grow their careers in the public and private sectors.

One organisation that has this as a principle goal is the Tawazun Economic Council, described as ‘the defence and security industry enabler responsible for the creation and development of a sustainable industry in the UAE’. Its economic programme seeks to attract both local and foreign finance to fund the continuous development of the sector, while promoting technology and knowledge transfer.

One of its initiatives is called Sustain & Enhance Emiratisation in Defence & Security (SEEDS). In short, it assists international defence related companies to offer internships and job placements to qualifying UAE nationals.

In March this year, the Abu Dhabi based advanced defence technology group EDGE signed a Memorandum of Understanding (MoU) with Tawazun to offer UAE nationals the opportunity to join some of its technology development programmes. Internships and jobs would be offered to high performing individuals allowing them to gain experience working on advanced technology, defence and security projects through the SEEDS programme. The MoU was signed between Dr Fahad Al Yafei, President – Platforms & Systems, EDGE, and Tawazun’s Matar Ali Al Romaithi.

Areas of priority identified by the SEEDS programme include systems engineering and architectures, modelling and simulation, component and module technologies, RF sensor technologies and applications and others.

EDGE has over 12,000 employees spread across 25 companies with revenues around $5 billion. The organisation will be recruiting and training UAE nationals from a selection of the country’s respected academic institutions including Khalifa University, Abu Dhabi Polytechnic, United Arab Emirates University, and the Higher College of Technology. Their target students are those who are studying for degrees in engineering and computer science.

On 21 July, EDGE announced that it had acquired the remaining 40 percent stake in the Advanced Military Maintenance Repair and Overhaul Centre (AMMROC) from Lockheed Martin/Sikorsky making it a wholly owned UAE company, although a number of commercial agreements will remain.

AMMROC is the authorised regional service centre for Lockheed Martin’s C-130 Hercules transport aircraft. In addition it provides MRO services for F-16 and depot MRO hub support for UH-60 Black Hawk helicopter components.

“Lockheed Martin and Sikorsky have played a pivotal role in developing the UAE’s MRO capabilities. As EDGE assumes full ownership of AMMROC and continues to pursue the military and civil MRO market with specialist skills, we recognise that such achievements are the outcome of our international partnerships,” said Faisal Al Bannai, CEO and managing director of EDGE.

EDGE has five different technology clusters: platforms and system; missiles and weapons; cyber defence; electronic warfare and intelligence; and mission support. Many companies within these clusters are seeking to export their products such as Nimr’s JAIS 4×4 infantry fighting vehicle.

Path to the Future

On 13 July, the organisers behind Abu Dhabi’s Global Aerospace Summit held a webinar to discuss Technology Transfer and Building the Defence Sector – Challenges and Opportunities.

Matar ali al Romaithi, chief economic development officer, Tawazun, said that in order to develop the defence sector, Tawazun was “looking at three pillars to develop technology in the country and make partners more keen to share their technology and Intellectual Property (IP).”

Firstly he said that investment in people was very important. Then came organisation and legislation to allow development to take place and be recognised. Finally he pointed to the need for the right level of systems and technologies to allow development to take place.

“In terms of technology, the UAE has become very competitive in the region, with educated people…and finding the right way of applying technology,” he said. He added that simply buying IP had not been seen as a practical solution. Instead, the UAE Government had “started [by] building manufacturing capability and then evolving the defence industry by attracting the right partners.”

“The UAE has been so focused and evolved this process…there is a level of maturity and experience that sets the model for the rest of the region,” said Robert Harward, CEO Middle East, Lockheed Martin. He said that IP had to be evaluated in terms of what’s its worth and cost, and that there were many stakeholders to consider including governments.

Harward said that Lockheed Martin’s policy was to link interns with company engineers and their projects to do “on the job training.” He added as that mentoring continued the interns grew into one of the more important aspects of the IP. The process would allow an Emirati engineer to replace an expatriate engineer.

The development of drones, cited Harward, was not simply a matter of the IP and concept but more how they would fit into the overall defence industry picture as well as the military concept of operations. They had to demonstrate a path from initial concept through to procurement then integration into the military system.

One of the issues faced by developers outside the United States is how to get their products validated and acceptable to the US Government. Once that is achieved, said Harward, the US Government is more able to support and understand that technology and speed up the process for it to integrate into the defence business.

Alan Davis, CEO, Raytheon Emirates, said that there was no limit to where the UAE national aerospace and defence community could go. Raytheon has been in the UAE for 30 years and he said that was just the beginning.

Davies stated that Tawazun had moved offset from a transactional relationship to a value proposition. “We end up investing as partners with technology, match it with training and leadership which allows us to develop new missions, markets and capabilities leading to business outside the UAE.”

Back in 2019, Davies had revealed that Raytheon Emirates would be helping to establish cyber academies and a ‘cyber range’ which would assist the UAE Government to identify, engage and defeat threats as they emerged.

Jay Little, vice president, Collins Aerospace said that he had he preferred the phrase ‘localisation’ to ‘technology transfer.’ Little also talked about the benefit of employing local talent “where we can create solutions for local customers” easier than doing it from the headquarters back in the US.

In addressing the question of barriers to effective technology transfer, al Romaithi said that “the link between industry and academia had been missing, particularly with regard to long term planning.” However, the Government policy in dealing with international partners not only in hiring UAE nationals through projects like SEEDS, but in ensuring that those people had the right expertise through the educational process to begin, was making them attractive to prospective employers. He added that the mix of international cultures that were well established within the UAE allowed good understanding. The SEEDS programme is making the “human capital grow as we go,” reminded al Romaithi.

However, Harward voiced concern that although people were the most important component, there was a capacity issue as they were the hardest. Forming a career path for them that they wanted to pursue in terms of staying for years and growing ‘in place’ was sometimes a challenge. “When they got to the end of their project they turned around and said they wanted to go and start their own business. But I need you to be committed to this business for five or six years. We have got to make that career path, enticing, realistic and something they believe in because when you talk about capacity we are all competing for that same gene pool.”

In terms of identifying technologies that the UAE is prioritising, Davies said that it starts with Defence Technology Security Administration (DTSA) approval. In the US, the DSTA ‘administers the development and implementation of Department of Defense (DoD) technology security policies on international transfers of defence-related goods, services and technologies.’ “We have already had an audit in the UAE working with the Minister of Defence and have the right procedures to guard both US and UAE technology,” stated Davies. This allows UAE industry to continue to have access to that technology.

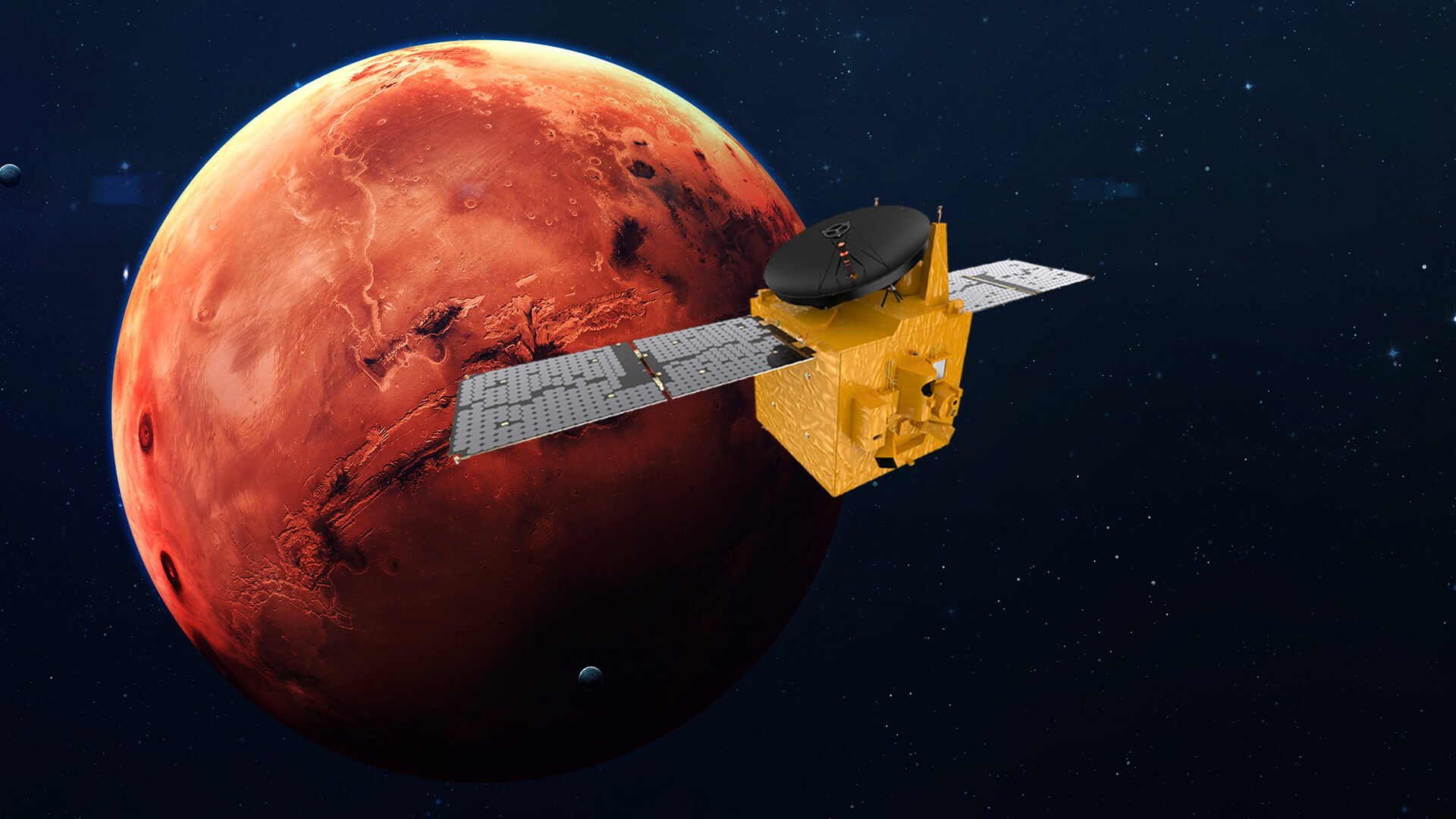

Davies noted that space is one sector that is going forward quickly, between five and 20 years ahead: “We are going to be focused on regional security, but the technology associated has multiple application.” He said that all of the mainstream companies were active in the space sector, and enabling that technology in the UAE would lead to international opportunities. “Nobody is going to get to space by themselves; it is going to be a collaborative effort. Nobody will get to Mars by themselves.”

Underlining that fact was the launch on 20 July 2020 of the Emirates Mars Mission which involves sending an orbiter named Hope to Mars. Headed by the United Arab Emirates Space Agency through the Mohammed bin Rashid Space Centre (MBRSC), it has been a collaborative effort between the MBRSC and the Laboratory for Atmospheric and Space Physics (LASP) at the University of Colorado Boulder, with support from Arizona State University (ASU) and the University of California, Berkeley. It was assembled at the University of Colorado. “This has been a great success at a very difficult time,” added al Romaithi, referring to all of the problems caused by the COVID-19 virus.

Little confirmed that the UAE needed to do work at a national level: “We need to do the innovation and technology development locally so it is not ITAR controlled or by another third party but Emirati controlled, so they can control their own destiny around their networked communications and security,” he said. “Then they will be able to export their creation.”

He added that Collins had technology that was not ITAR controlled through its civil business that could be transferred that could then be the subject of local innovation and subsequently exported.